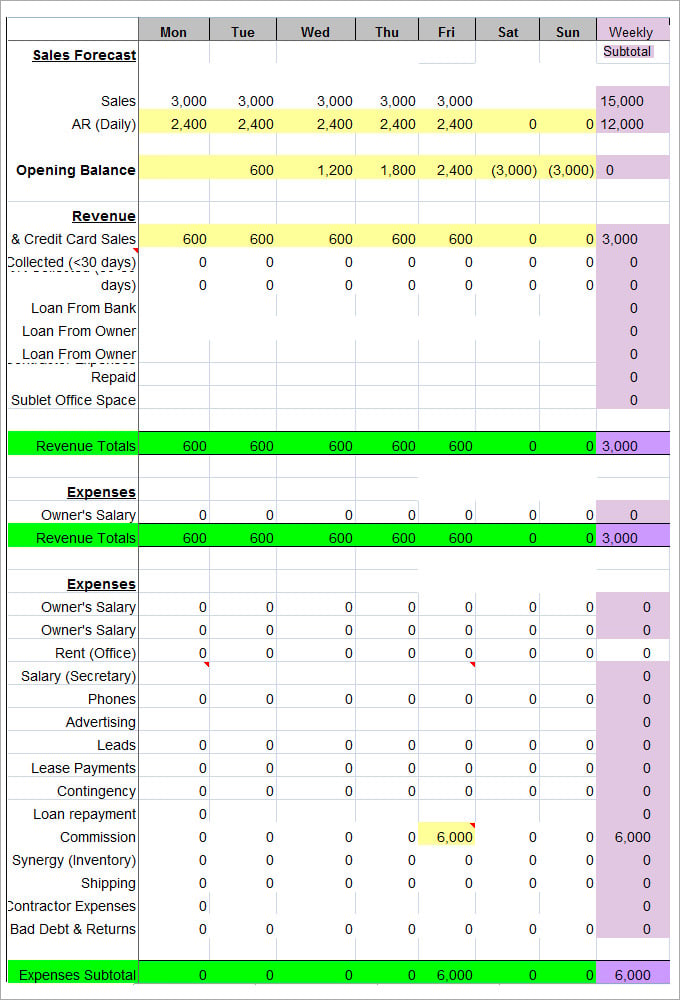

For others that need more tracking and discipline, it is better to record category of spend. However, as compared to other people, I do not keep track of the category of spending (This only works for me and I am sure I spend within limit, so I don’t want spend too much time on this). dividends) that I am getting from my portfolio, all buy and sell transactions, dividend coming in, location of all my funds, and what insurances I have.įor any card spending, I record it in an app to keep track and make sure I spend within budget and hit the $500 spending for UOB. Record how much I am vested, how much emergency funds I have, how much investible funds I have, how much cashflow (e.g.By doing so, it is easier to hit the $500 spending! The remaining $400 to $500 is spent on household expenses such as SimplyGo for transport, groceries, and of course, I have also passed a UOB ONE subcard to my wife for her to spend on this card. I set up recurring charges for my mobile line, broadband, and utilities bill to this card, which amounts to around $100 to $200 each month. To meet the UOB One account’s 5% interest rate, I would spend $500 starting from the 3rd of every month (my billing cycle starts on the 3rd of every month). Of course my UOB ONE Card is used with my UOB one account to get the 5% interest every month! I currently own several credit cards, but my three main credit cards are UOB One Credit Card, SCB Spree Credit Card, and Unlimited SCB Credit Card. In case I am suddenly gone (yes, touch wood but life is uncertain), hopefully this could be a good reference for them.

Personally, it will be good for my kids/spouse, especially who is totally don’t bother with cashflow management or finance management in my household.

0 kommentar(er)

0 kommentar(er)